Is it possible to squeeze a further 60% growth from a portfolio without investing more money? Can it be done without incurring more risk or speculative trades? The answer is yes and yes. We’ll show you how we achieved this using portfolio optimization and rebalancing to find the free “rebalancing bonus” inside the All Weather Fund. In our analysis, we unlocked a further $61,500 from a $100,000 portfolio and grew it to over $338,000.

You may be wondering how much is the “rebalancing bonus” inside your portfolio?

For this insight series we will be using equily, the model portfolio platform, where you can build, optimize and share model portfolios across the investment community. You can try equily out on your own portfolio to find your “rebalancing bonus”, simulate new strategies and see what others are doing. During the series, we’ll explore the truth about portfolio optimization, unpack some of the world’s most famous funds and give insights on user-submitted portfolios.

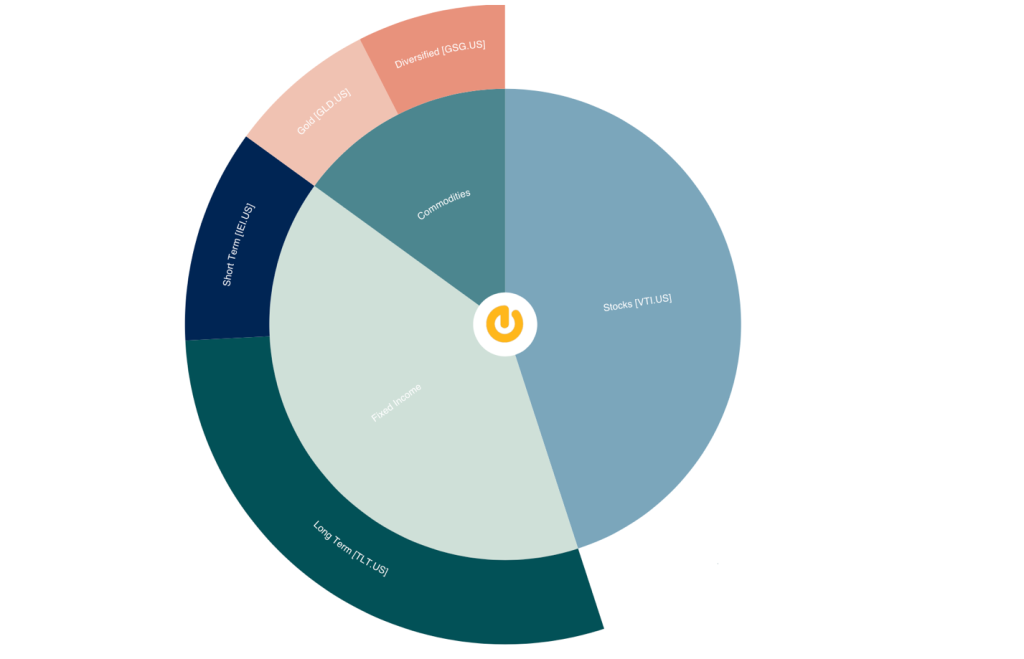

In this equily insight we’ll unpack Ray Dalio’s All Weather Fund, a diversified asset allocation mix that took Ray and his team at Bridgewater Associates around 25 years research to discover. The All Weather fund is designed to do well regardless of macro-economic conditions, which we think it’s probably as useful today as it was when it emerged in 1996.

The Results – All Weather Fund Optimization

To create the results, we simply built an ETF version of the All Weather fund and then optimized it using 5 proven rebalancing strategies powered by equily. A visual of our All Weather model portfolio that we created inside equily is shown below.

Diagram 1: The All Weather Fund – ETF Model Portfolio

Having built our All Weather model we then ran portfolio optimization using back testing that grabbed historical ETF data going back 16 years to January 2007. The back testing framework allowed us to run 61 unique tests across 5 different strategies and 13,000 simulated trades.

The Winning Strategies

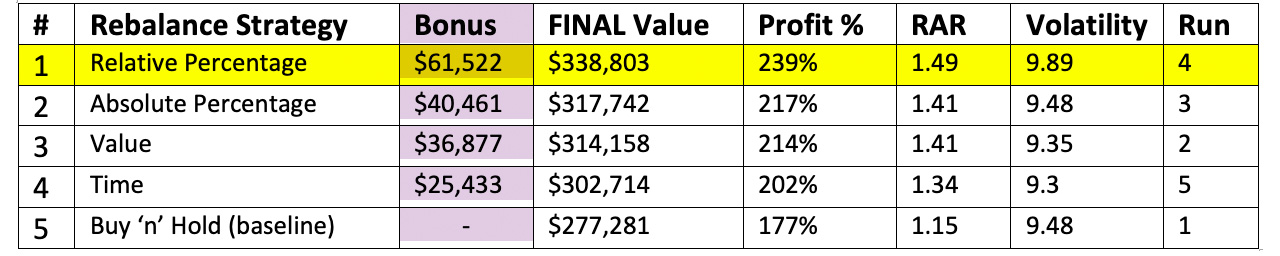

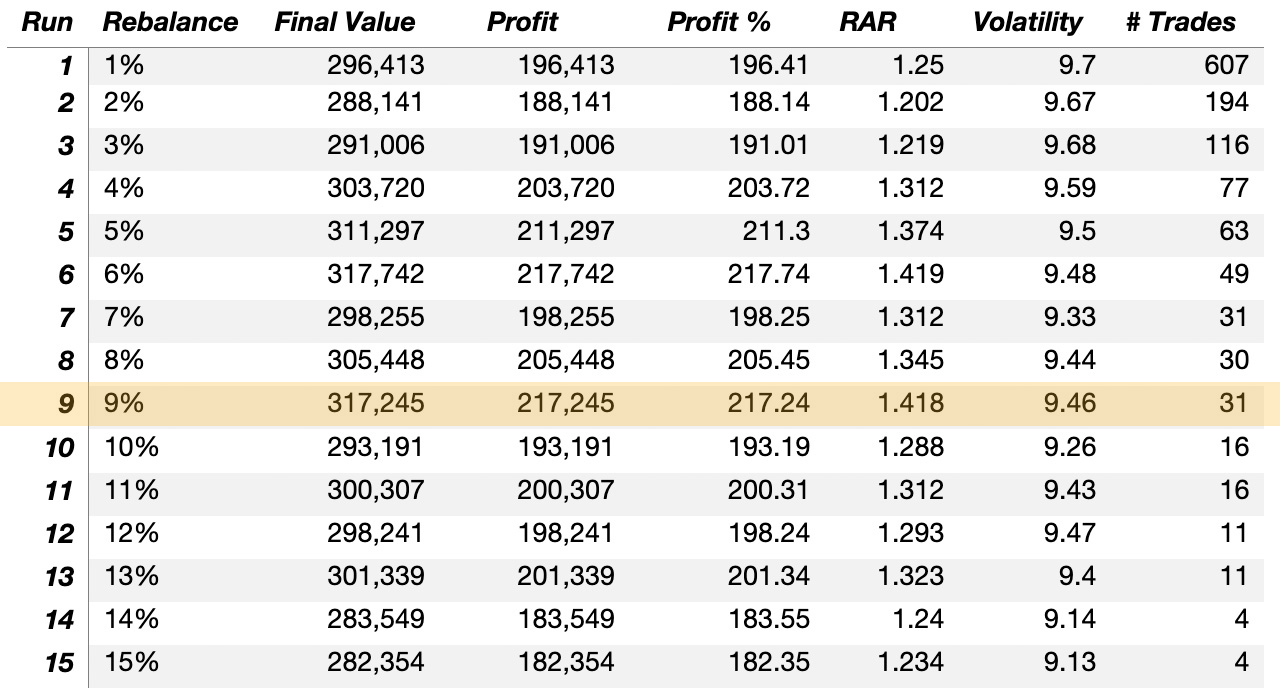

The table below shows the winning portfolio optimization strategies for the All Weather fund sorted by risk adjusted return (RAR). As you can see, the overall winning strategy is to use a relative percentage of 35%. This created a $61,522 (61.5%) “rebalancing bonus” based on a $100,000 starting portfolio. This is essentially $61,522 of free money that is created by rebalancing using an optimal approach.

Table 1: The Winning Rebalancing strategies for All Weather fund (ETF)

The best risk adjusted return (RAR) of 1.49, also known as the Sharpe ratio, is really quite strong and a notable improvement on the baseline buy ‘n’ hold approach of 1.15. But our testing showed that all rebalancing improves on the baseline.

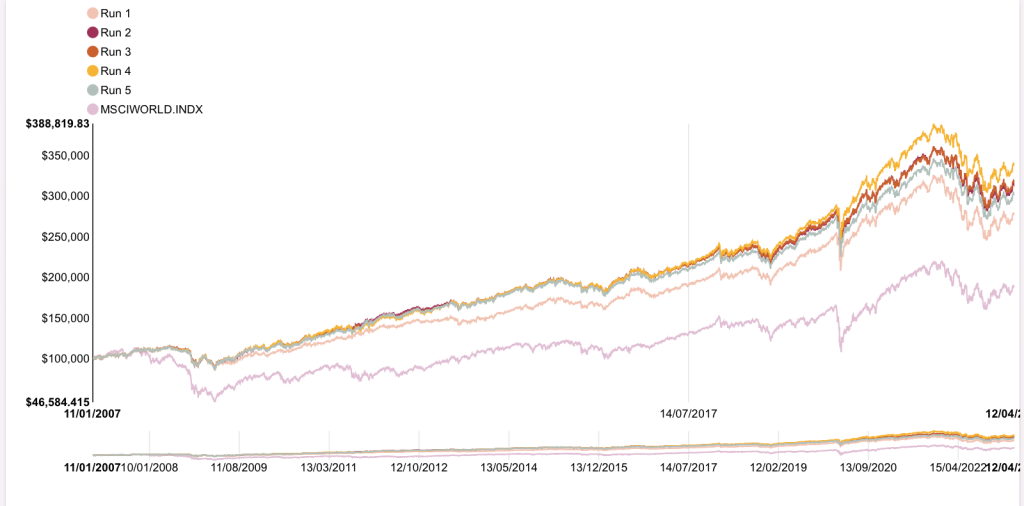

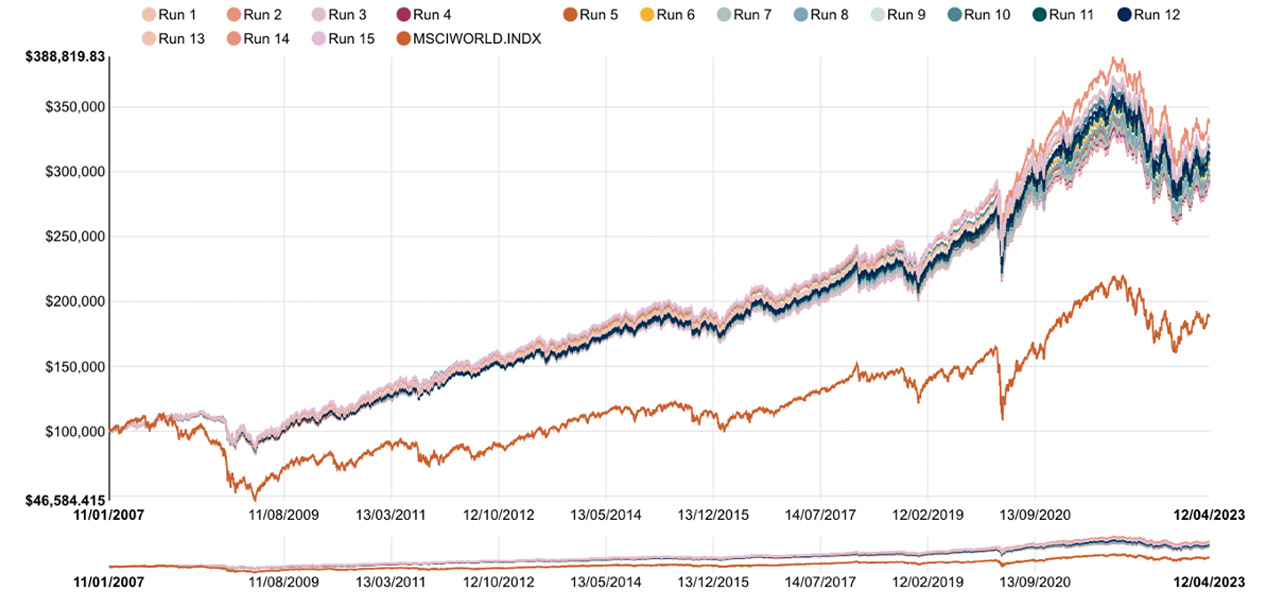

The diagram below shows the winning results by rebalance strategy for a simulated All Weather fund investment of $100,000 over the last 16 years and a benchmark comparison against the MCSI world index.

Diagram 2: The Winning Rebalancing Strategies by category

What the winning results show is that all rebalancing strategies have a positive impact for All Weather fund investors. The baseline performance (Run 1) is simply to buy and hold the All Weather fund since January 2007. Investors who did this could have made 1.7 times their initial investment over a period of 16 years.

Best Performer (61% bonus) – the overall winning strategy is to rebalance the All Weather fund on a relative percentage basis of 35% (Run 4). That yielded a return of 2.39 times the initial investment over the same 16 years period. Using this strategy, you could have made an additional $61,500 with no additional capital or materially increased risk. The “rebalancing bonus” represents 61.5% of your original $100,000 starting capital, so it’s a massive contribution to All Weather investment returns.

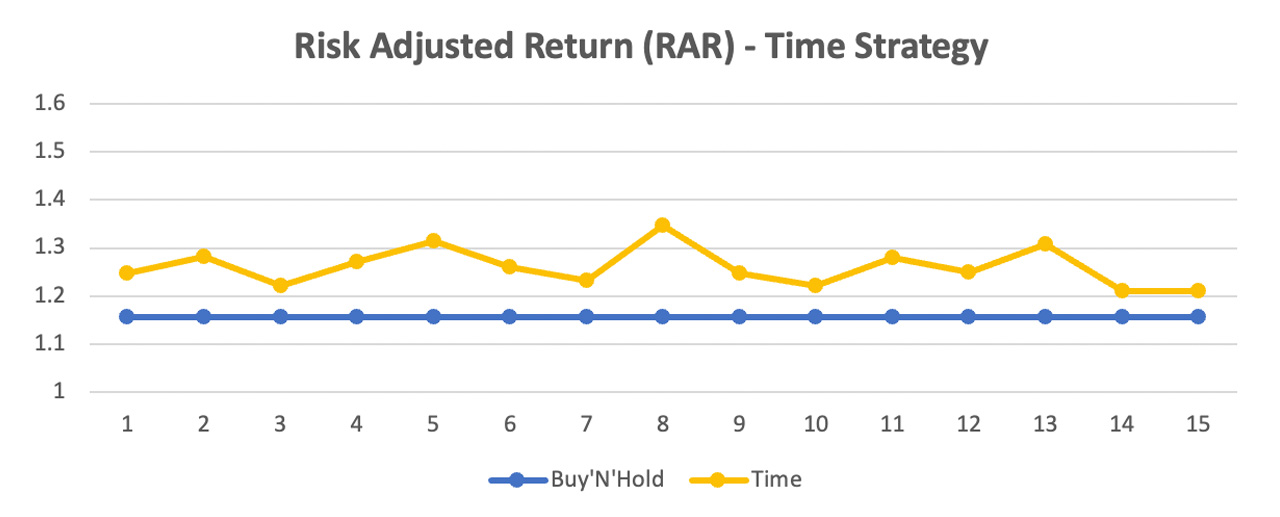

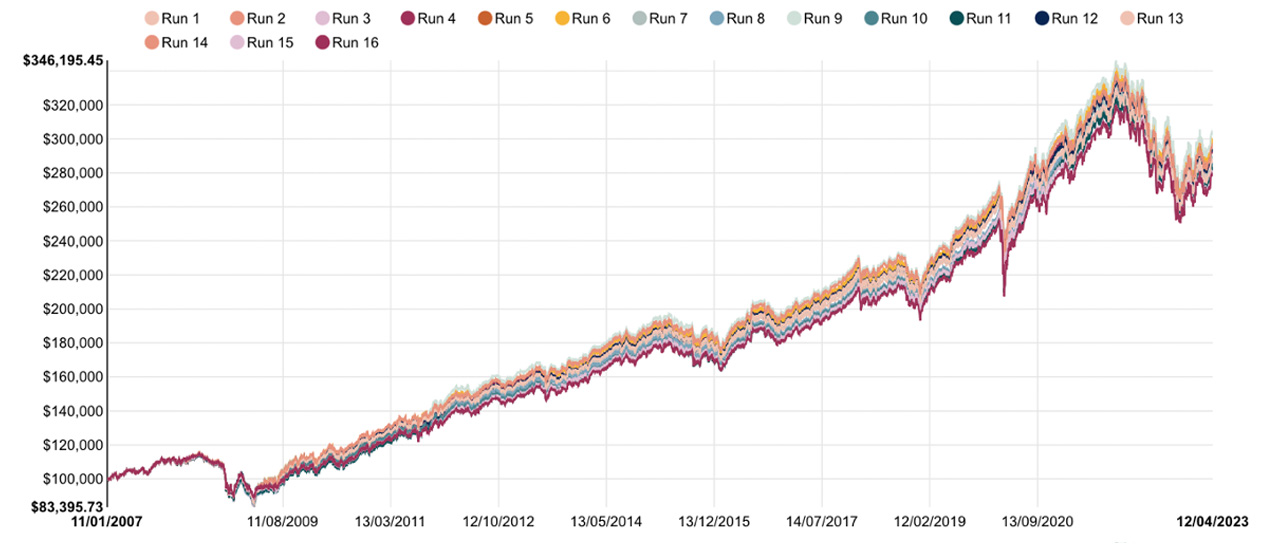

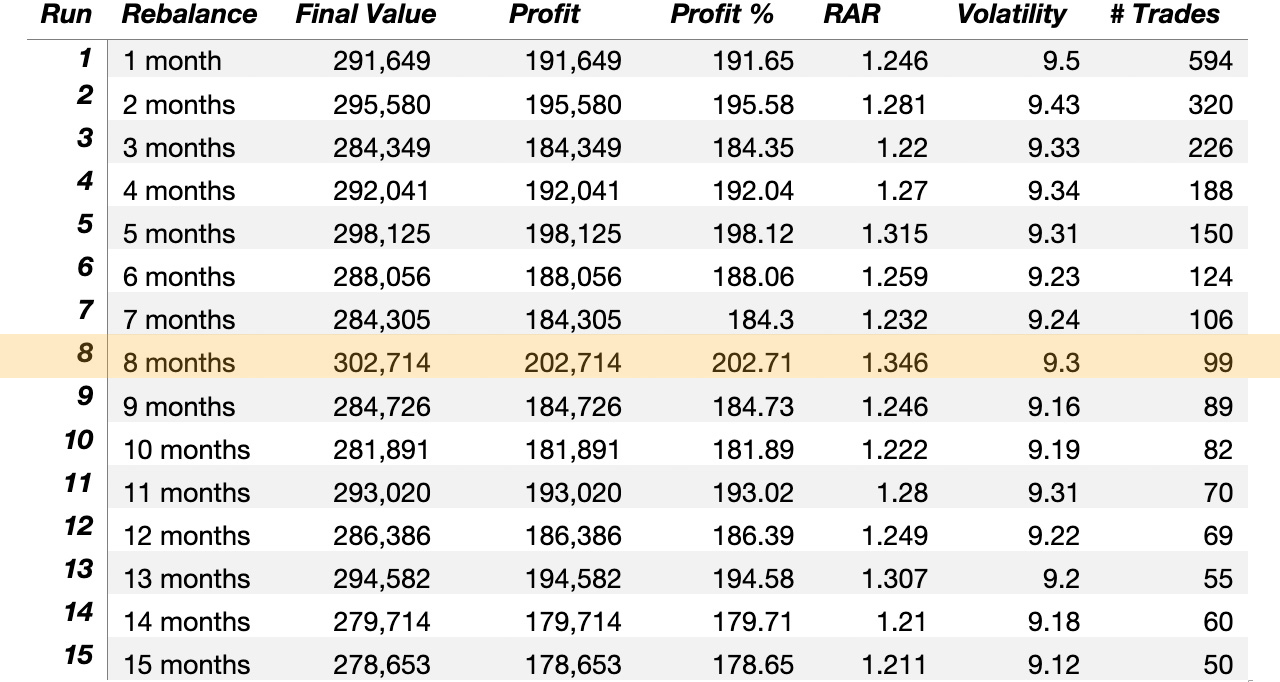

Least risk (15% bonus) – the lowest risk approach is to rebalance on a time-based strategy (Run 5). In our back testing, 8 months was the optimal point for the All Weather fund and it still yields over 200% profit. This strategy created a $15,000 “rebalancing bonus” with the lowest risk available.

Balancing Risk & Returns (40% bonus) – lastly, using an absolute percentage approach (Run 3) gives you a good balance between risk and returns. It gives precisely the same volatility as the baseline (Run 1) but with the advantage of 40% increase in profits to achieve a rebalancing bonus of $40,000.

Annual Rebalance (9% bonus) – many financial advisors rebalance portfolios during a yearly review. Based on our backtesting, if you were to rebalance every 12 months with the All Weather fund, then returns would be 186%. This represents a rebalancing bonus of $9,000 or 9% of initial capital. It shows there is little science to rebalancing annually and is probably more about convenience.

Conclusion

The All Weather fund can be optimized significantly using proven rebalancing strategies that all outperform a buy ‘n’ hold strategy. Based on our testing, it is possible to squeeze up to 61.5% more returns using the optimal rebalancing strategy to create a rebalancing bonus.

We need to be clear this is not a “secret” formula for consistently beating the market. We believe in taking an evidence-based approach to investing within a diversified portfolio and optimization strategy. The data shows that you can grow your investment pot over the long-term and squeeze further value by rebalancing the All Weather Fund. We’ll explore other funds/portfolios in future equily Insights.

If you want to understand more about our testing, you can read further below:

• Our Testing Approach

• Detailed Results by Category

Lastly, before you rush off to invest in the All Weather fund, you should know that like many assets it’s also lost value in the last year of around 6.4%. But that it’s marginally better than the S&P 500 that has lost 7% in the same period. So as always, invest sensibly and with a long-term horizon.

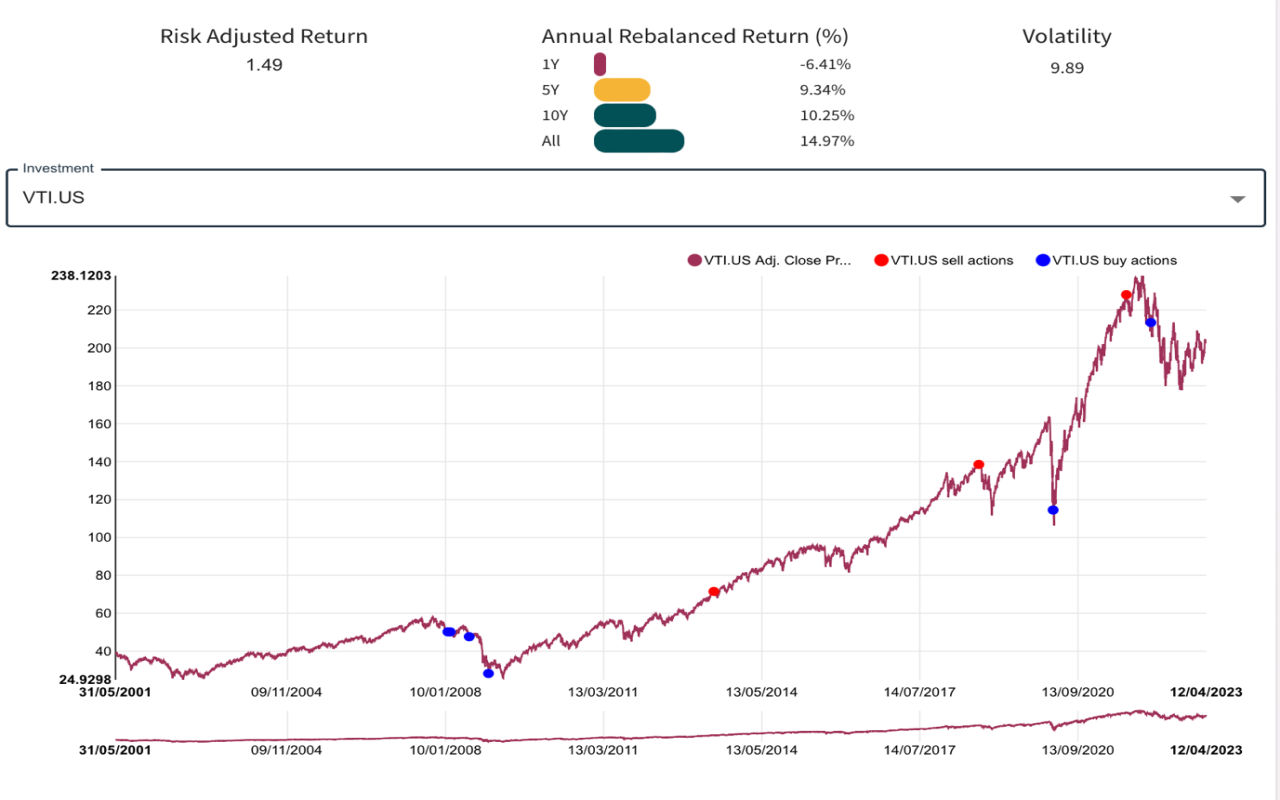

Diagram 3: Summary of All Weather Performance with VTI buy & sells triggered by portfolio rebalancing

Our Testing Approach

Using equily, we built and optimized an ETF version of the All Weather fund using 5 different rebalancing strategies:

- Zero Rebalancing: Buy ‘n’ hold – ok technically this is NOT to rebalance at all. Simply buy and hold your portfolio forever. I’m sure a famously patient investor like Warren Buffet would love this approach.

- Calendar Rebalancing: Time – many financial advisors rebalance their client portfolios during an annual review. We were curious about this one as it literally means the trigger for rebalancing is one earth orbit of our nearest star. Feels more astrological than science but let’s see if it works!

- Fixed Rebalancing: Value – in this strategy the rebalance trigger is when an investment increases by a pre-defined value. Perhaps when your return is in excess of $2,500 dollars, that triggers a rebalance back to your defined allocations.

- Percentage Rebalancing: Absolute and Relative – ok this is where it gets a little bit into maths. There are actually 2 types of percentages of portfolio strategies; absolute percentage and relative percentage. For easy illustration, let’s assume you have a $100K portfolio, which has 4 investments of $25K each and we use 10% as the rebalancing trigger.

a. An absolute percentage is simply 10% of the total portfolio value: $100K x 10% = $10K. So if one of your investments increased by $10K it triggers a rebalance.

b. A relative percentage is simply measured by each investment rather than total portfolio. Hence $25K x 10% = $2.5K. So one of your investments only needs to increase by $2.5K to trigger a rebalance.

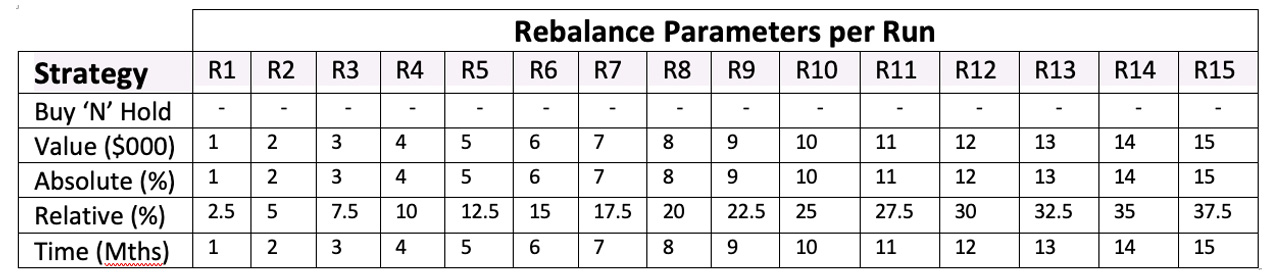

Our approach was to run 15 back-tests per rebalance strategy plus the baseline buy ‘n’ hold strategy. That created 61 different tests with the following rebalance parameters for each of the 15 runs.

Table 2: Rebalancing parameters by strategy across 15 runs

To make the maths easier to compare on profits, we chose a $100,000 starting portfolio value.

Detailed Results

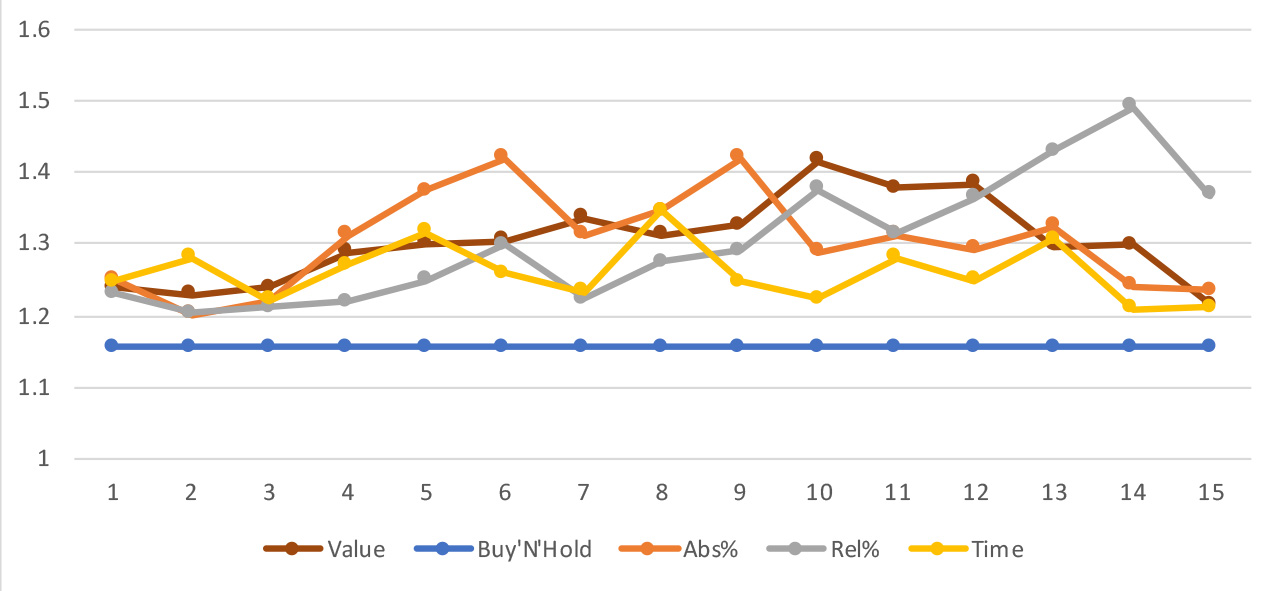

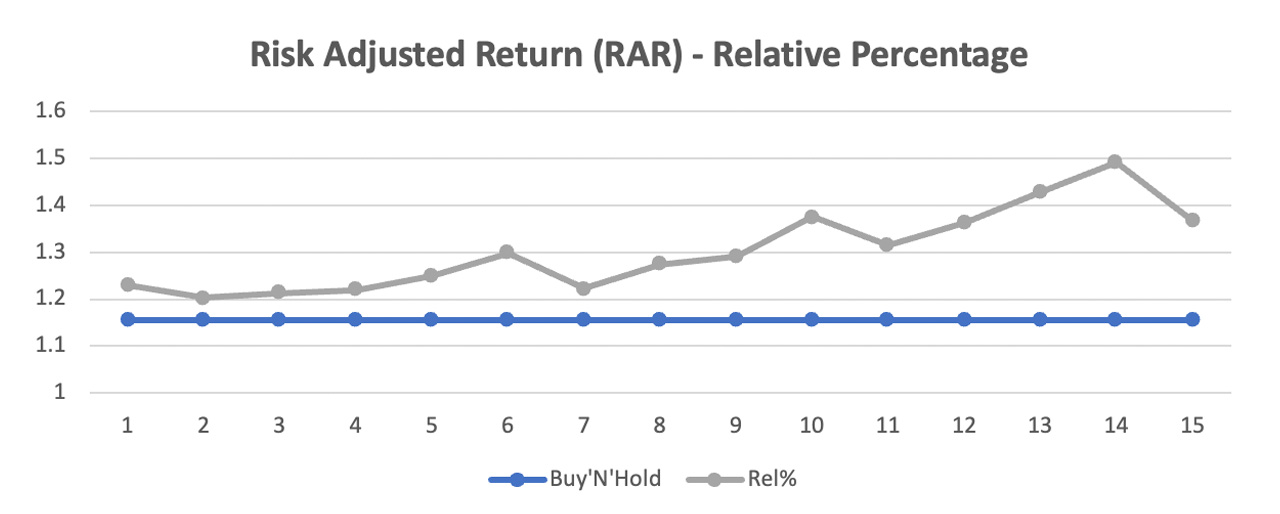

This section contains the detailed results by rebalancing category. Commencing with an overview of the risk adjusted returns for all strategies across the 15 runs.

Diagram 4: Risk Adjust Return (RAR) for all strategies across 15 runs

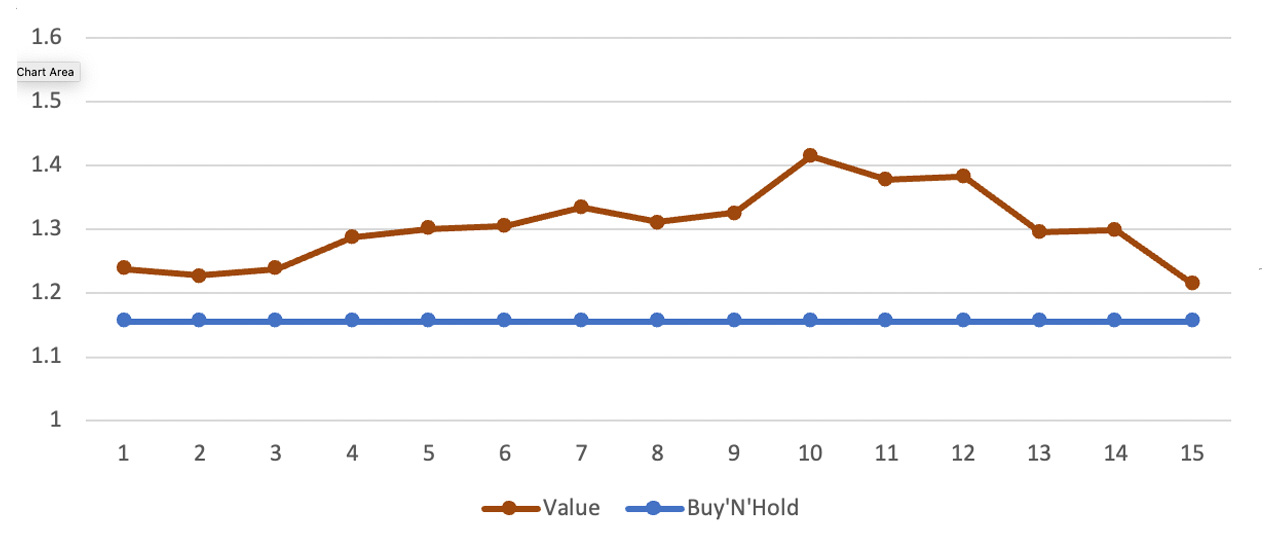

Rebalancing Strategy – Value

Diagram 5: Risk Adjust Return (RAR) by value strategy across 15 runs

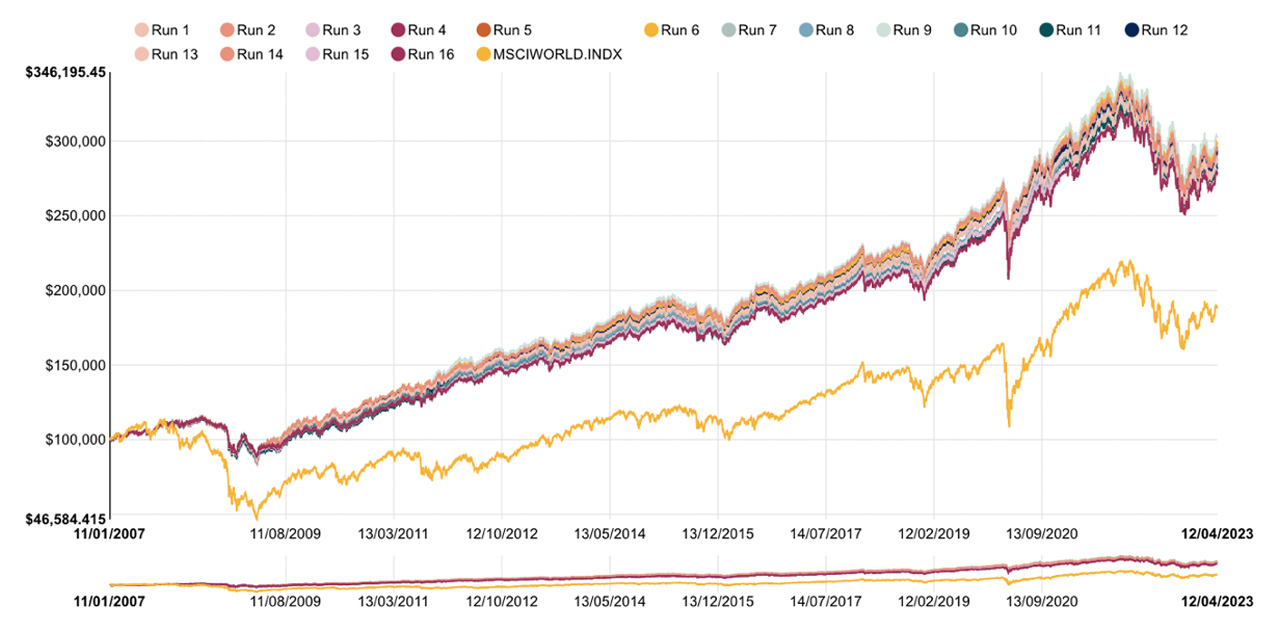

Diagram 6: All Weather revenue growth by value rebalancing strategy since 2007

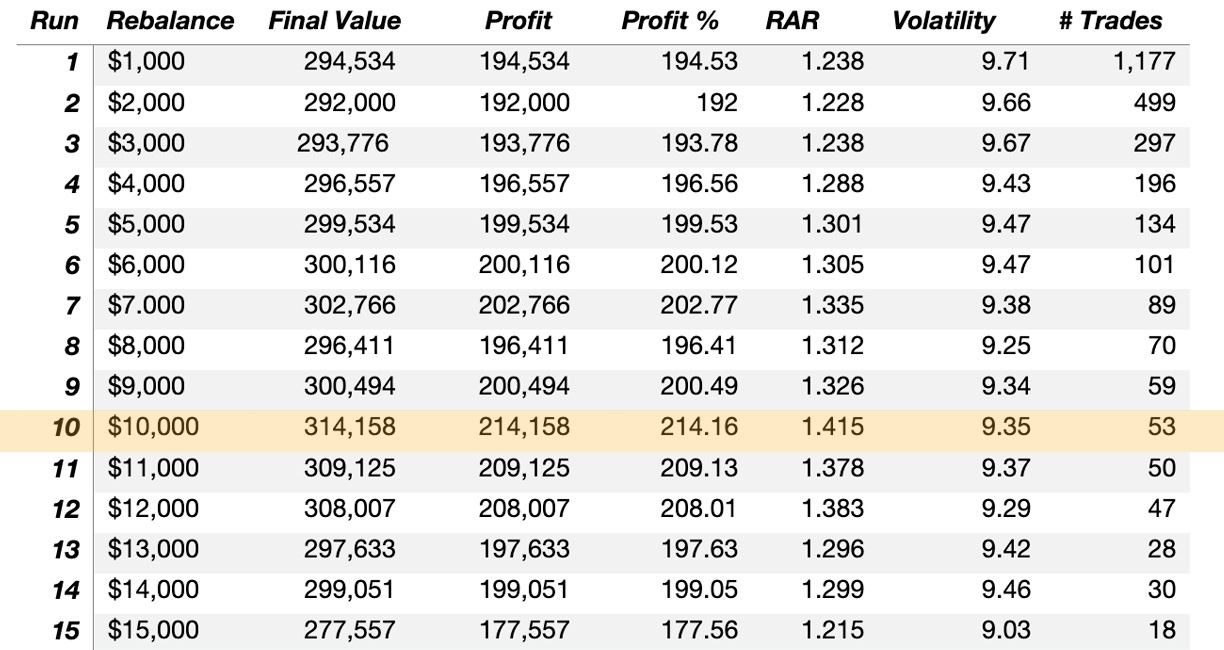

Table 3: Detailed results for value rebalancing strategy

Absolute Percentage

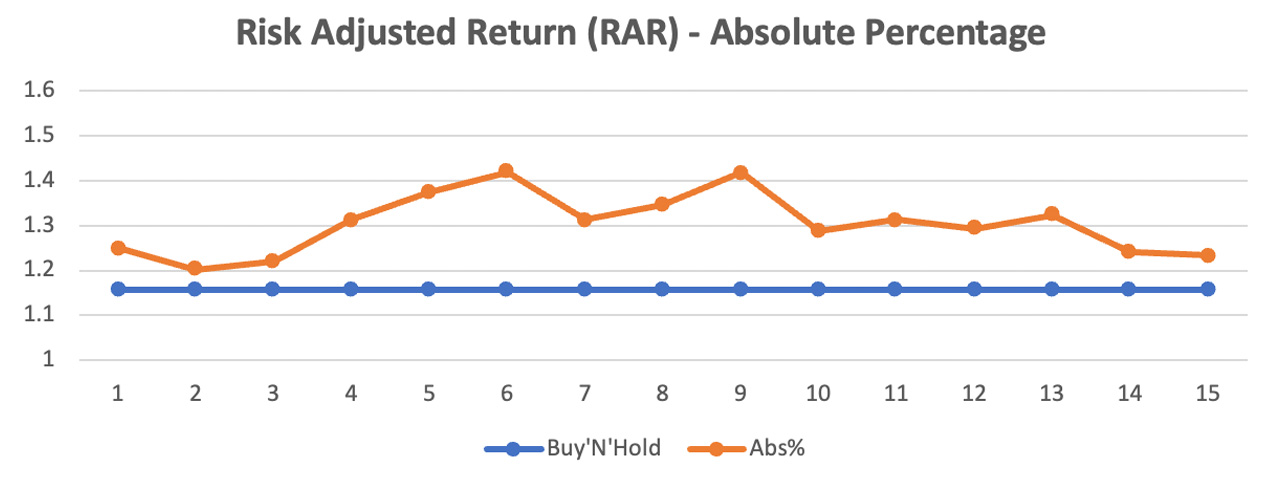

Diagram 7: Risk Adjust Return (RAR) by absolute percentage strategy across 15 runs

Diagram 8: All Weather revenue growth by absolute percentage strategy since 2007

Table 4: Detailed results for absolute percentage rebalancing strategy

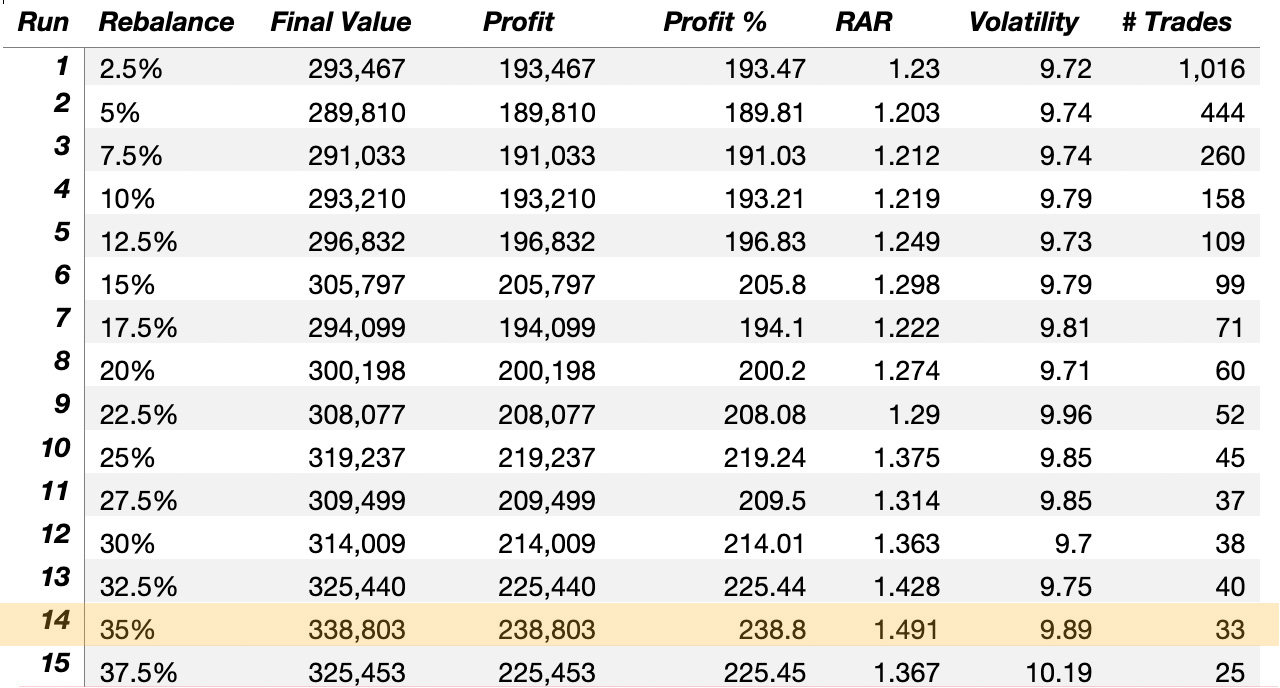

Relative percentage

Diagram 9: Risk Adjust Return (RAR) by relative percentage strategy across 15 runs

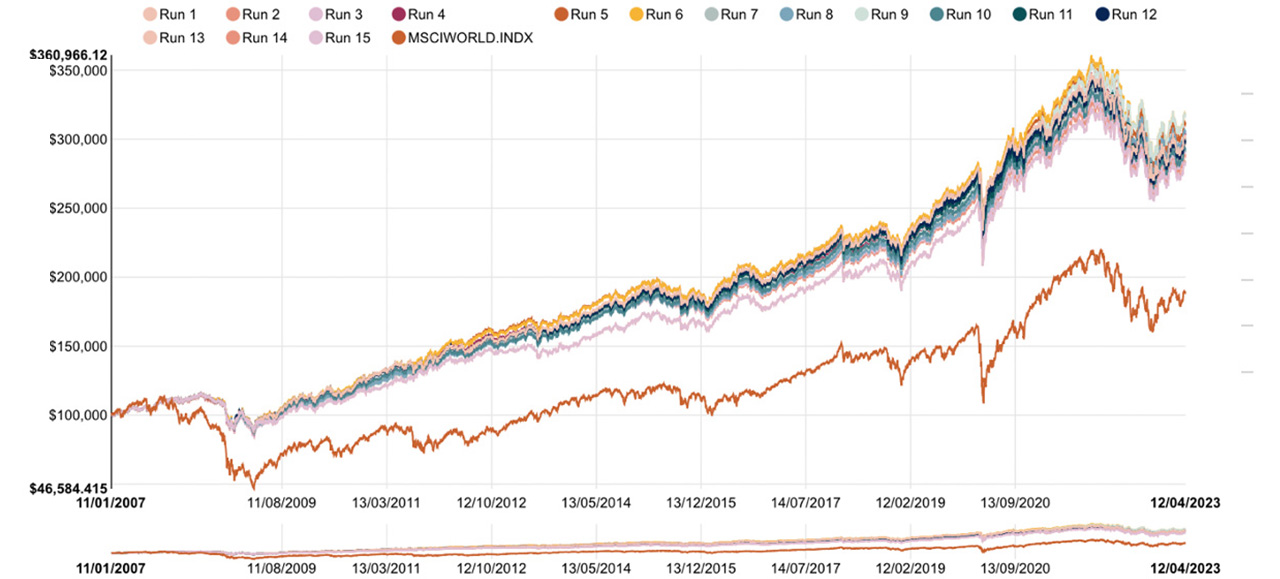

Diagram 10: All Weather revenue growth by relative percentage strategy since 2007

Table 5: Detailed results for relative percentage rebalancing strategy

Time

Diagram 11: Risk Adjust Return (RAR) by time strategy across 15 runs

Diagram 12: All Weather revenue growth by time strategy since 2007

Table 6: Detailed results for time rebalancing strategy

Please note, when investing, your capital is at risk, and returns are uncertain. The information in these blog posts does not constitute financial advice and should not be considered as such.

Helen Lawton

equily co-founder

A Cambridge graduate, Helen worked at the Bank of England for ten years in various roles, including working for the now-Governor, Andrew Bailey. Helen worked in the area of the Bank responsible for banknotes, as an economist working for the Monetary Policy Committee, and in the aftermath of the 2008 global financial crisis, she worked in the area of the Bank responsible for financial stability. Helen has worked as a senior analyst in Holland, Hahn & Wills, a boutique wealth management firm based in England.

Helen’s research into sensible investing was the foundation for equily’s conception.

0 Comments